Euromonitor International has released new research about Grocery Retailing in Europe. Please see below some insights about European countries and companies.

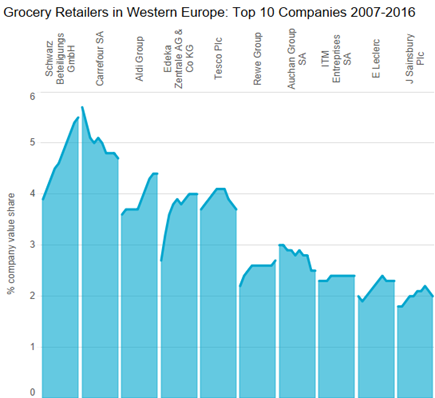

Schwarz Beteiligungs GmbH is the leading grocery retailer in Western Europe despite not being ranked first in any single market. However, the group has presence in all Western European markets bar Norway and Turkey with discounter Lidl its flagship brand as well as owning the German supermarket brand Kaufland.

All of the top 10 companies are headquartered in Western Europe, although US giant Wal-Mart, which owns UK supermarket Asda, is ranked 11th. In 15 of the 17 markets, a domestic player is the leading grocery retailer, with just Greece and Austria the exceptions, with consumers favouring local grocery retailers.

– In the majority of Western European markets, the grocery retailing landscape is dominated by the top five ranked companies, which have a combined 60% share or higher.

– The biggest players in the Nordic countries enjoy a near monopoly of the market and the top five have at least an 80% share with Nordic consumers displaying a clear preference for domestic retailers.

– The UK was the only market where the dominance of the top five companies waned over the review period. Discounters, Aldi and Lidl, are heavily responsible for this shift, with both retailers experiencing exponential growth over 2007-2016.

Philip Benton, Lead Analyst at Euromonitor comments: “Greece, Denmark and the Netherlands are the only Western European markets forecast negative growth in grocery retailing over 2016-2021, although all are relatively minor declines. Improving economies will push up inflation and help the bottom lines of grocery retailers that have struggled to make significant profits during the economic downturn. The UK faces an uncertain future in the wake of Brexit which is likely to mean increased costs for grocery retailers who may pass these onto consumers ensuring any value growth in the market will be minimal. Despite this, it remains the second largest market in Western Europe just behind France but ahead of Germany. France is the largest grocery retailing market in terms of value sales due to the popularity of hypermarkets for French consumers who use the stores for not only their regular food shopping but also for a range of non-grocery goods too. Despite Germany having the largest population in Western Europe and reporting positive growth in the grocery retailing market, it is only ranked third. This is due to German consumers’ love of discounters and “value for money” shopping which is a trend that has spread around Europe but keeps average spending at a much lower level in Germany versus France and the UK.The popularity of discounters has stemmed the growth of value sales in the review period for selected markets due to consumers trading down from more expensive supermarkets. However, there has been a switch from leading discounter Lidl to be more “soft”, which will result in the premiumisation of products which could boost value sales growth once more.”

If you would like additional information or insights for a specific country, please let me know.

We are pleased to share our data and insight with journalists. These are our requirements when using our content:

- Please cite all references to “Euromonitor, a market research provider” or “Market research provider, Euromonitor International”.

- Whenever possible, please also hyperlink our name to our website at: www.euromonitor.com

- To maintain the accuracy of our data and our analysts’ points of view, citations should not be paraphrased or used out of context. Should you use our analysts’ insights, please credit: “name, surname, title, Euromonitor”

- To receive more insights from Euromonitor analysts, please contact me and I will verify their availability

- Do not publish spreadsheets, tables, PDFs, reports or other data/insight provided in full externally; Please keep those internal and confidential. However, feel free to mention the data in your article or create graphs and charts, crediting Euromonitor International. Note: should you want to publish part of a report or a table, please reach out to me for any clarifications.